For each asset class/currency, a broker can select one of the fee-per-trade client markup types listed below, one markup type per asset class/currency.

Note: Broker client markups are limited to 45 times our standard commissions. If the Broker submits a markup that is above 15 times, we will receive 1/15 of the amount above 15 times.

Brokers can specify a minimum amount to charge per trade. The minimum amount cannot exceed the following limits:

| Currency | Minimum Fee Per Trade Limit |

|---|---|

| USD | 25 |

| EUR | 20 |

| CHF | 30 |

| GBP | 15 |

| CAD | 30 |

| JPY | 2500 |

| HKD | 20 |

| SEK | 175 |

| MXN | 250 |

| KRW | 20000 |

| AUD | 30 |

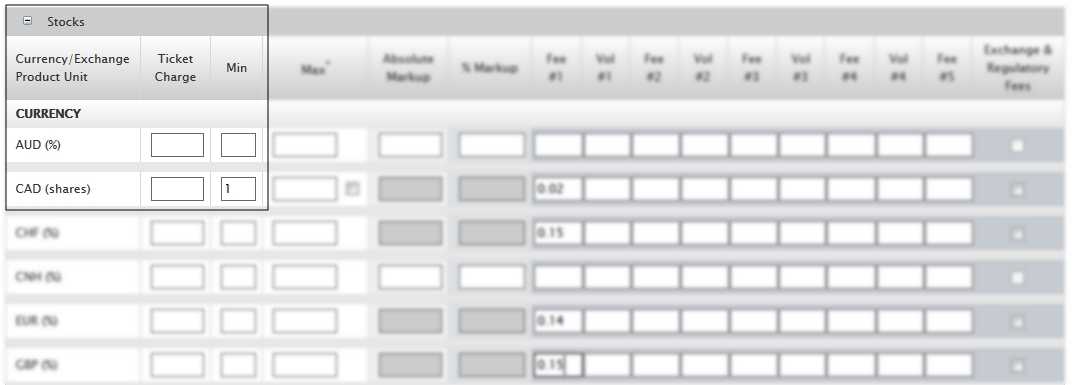

Note that you cannot enter both a minimum amount per trade and a ticket charge. You can enter one or the other.

Example

For example, a broker enters 1 in the Min column for Stocks/CAD for an individual client account. The minimum broker client fee for a stock trade in CAD for that client will be 1.00. A broker would typically set the Minimum Amount in conjunction with other types of client markups for a specific asset class/currency.

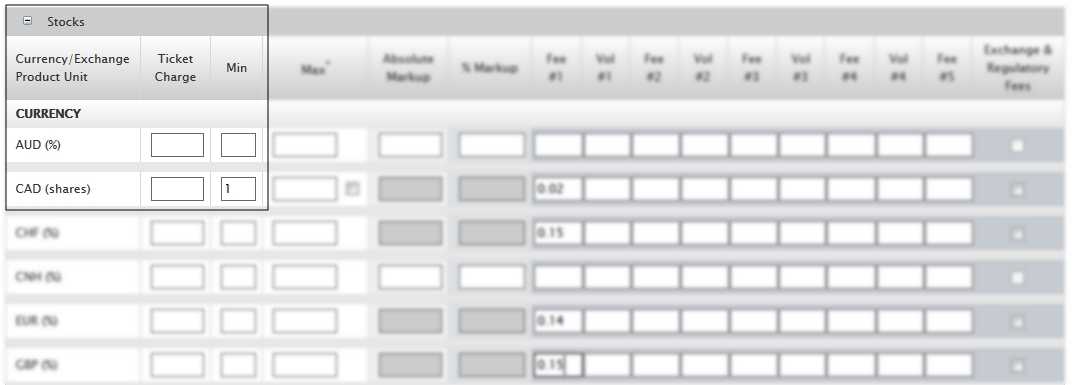

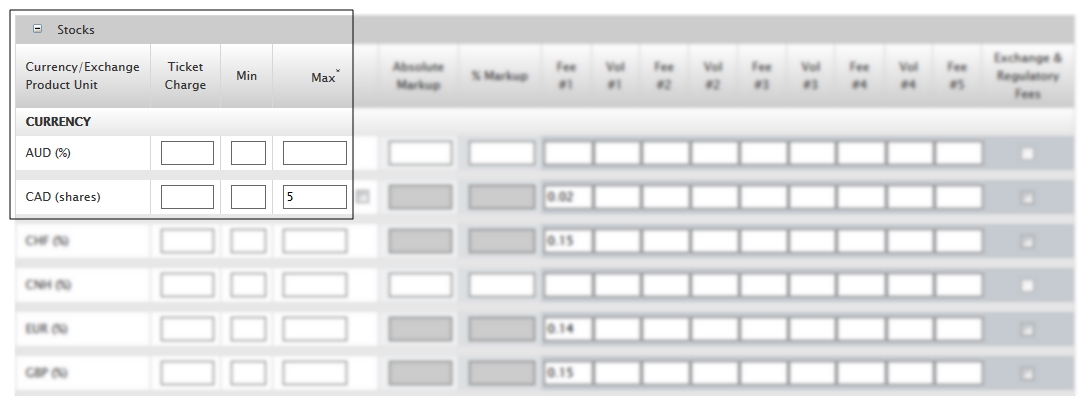

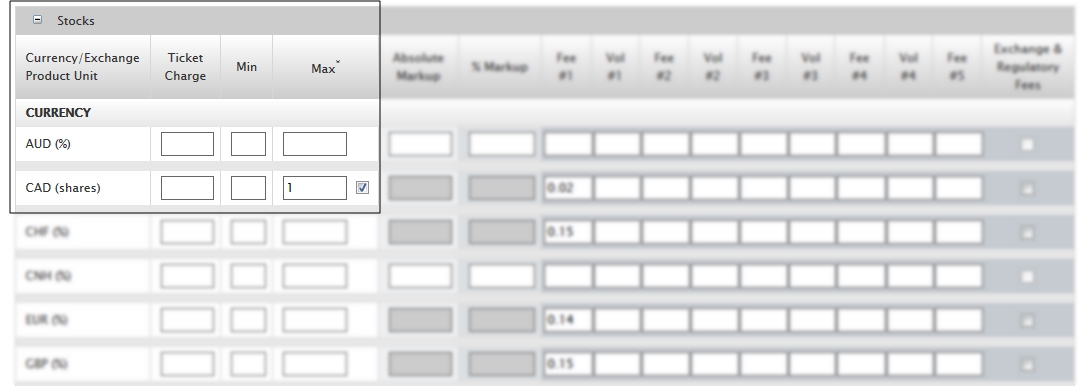

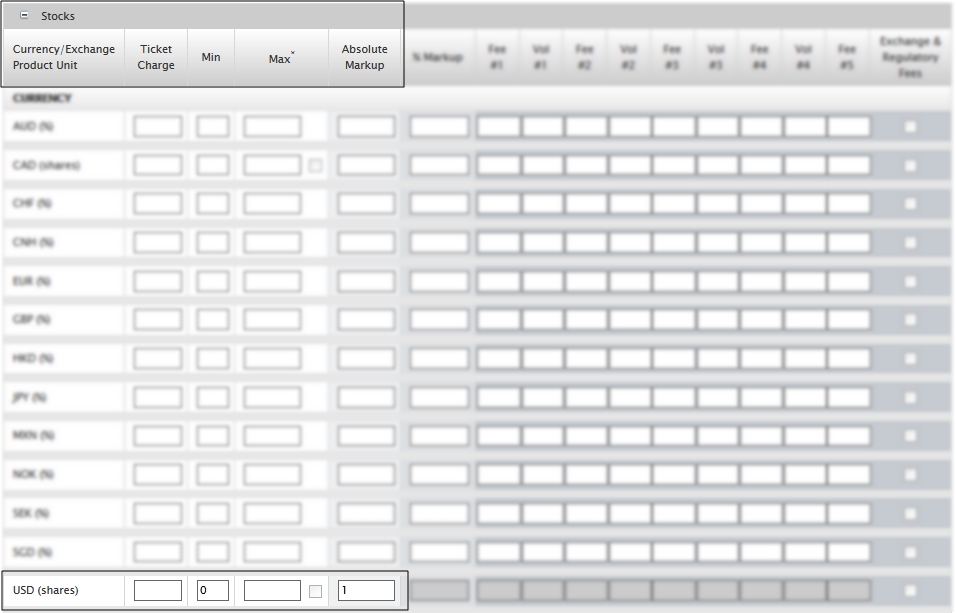

Brokers can specify a maximum amount to charge per trade. They can also configure the Maximum Amount as a percent of trade value for stocks in USD and CAD by clicking the check box below the Max entry field on the Client Fees page in Account Management.

Example

For example, a broker enters 5 in the Max column for Stocks/CAD for an individual client account. The maximum broker client fee for a stock trade in CAD for that client will be 5.00. A broker would typically set the Maximum Amount in conjunction with other types of client markups for a specific asset class/currency.

In another example, a broker enters 1 in the Max column for Stocks/CAD for an individual client account, and selects the check box below the Max field, indicating that this Maximum Amount will be calculated as a percentage of trade value of Stocks/CAD. The maximum broker client fee for a stock trade in CAD for the client will be 1% of the stock trade value.

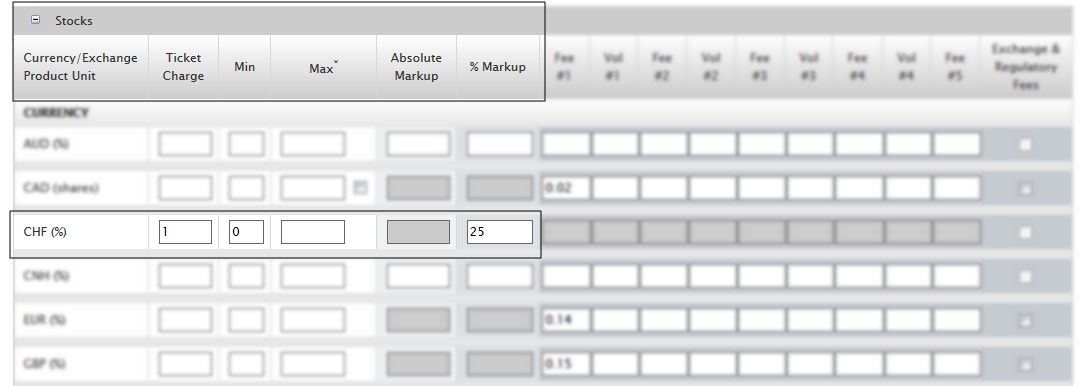

Brokers can specify a ticket charge per trade. A ticket charge is simply an additional flat fee. You cannot specify both a minimum amount AND a ticket charge for a single asset class/currency.

Example

For example, a broker enters 25 in the % Markup column for Stocks/CHF and then enters 1 in the Ticket Charge column for an individual client. The broker markup for a stock trade in Swiss Francs for this client will be 25% of our commission + 1CFH.

Brokers can charge an Absolute Markup per trade. Absolute Markup is a specific amount added to our commission. Brokers enter an Absolute Markup in the currency or exchange of the asset class. On the Client Fees page in Account Management, the units listed in the Currency/Exchange/Product Unit column indicate if the absolute markup gets applied to shares, contracts, or % of notional value. Absolute Markup amounts can include up to three decimal places.

Example

For example, a broker enters 1 as the Absolute Markup for USD Stock and Index Options. Later, one Smart option contract is executed. The client will be charged $2 ($1

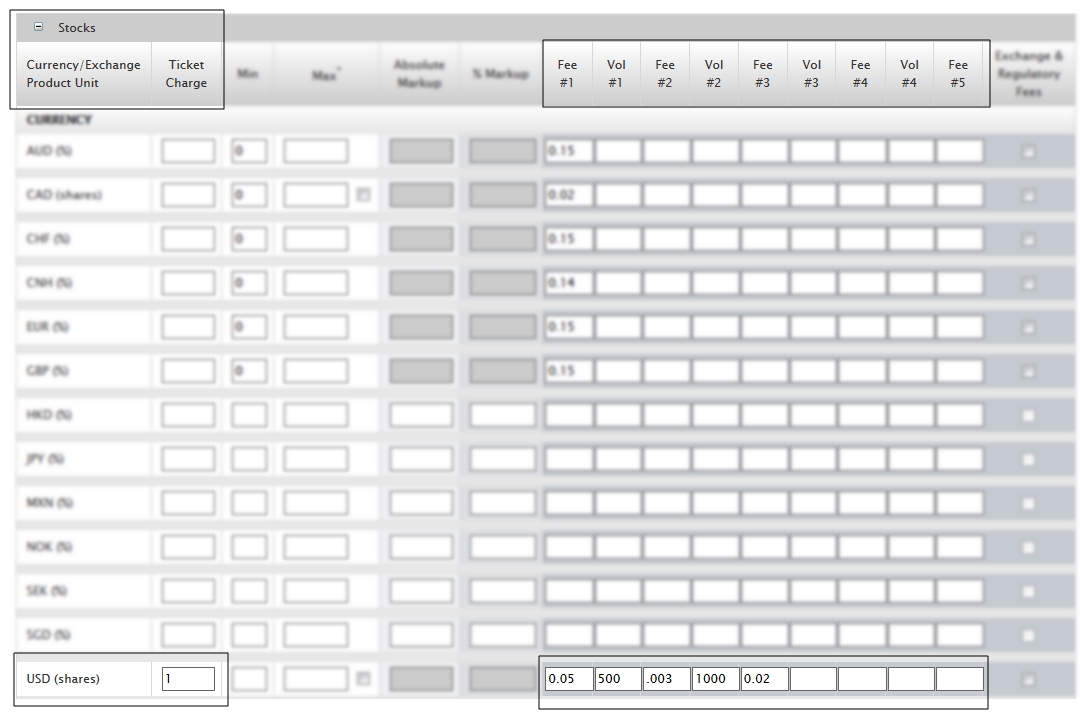

Brokers can charge an Absolute Amount from which our commission is subtracted. You can set up to three tiers for Absolute Amount based on volume breaks.

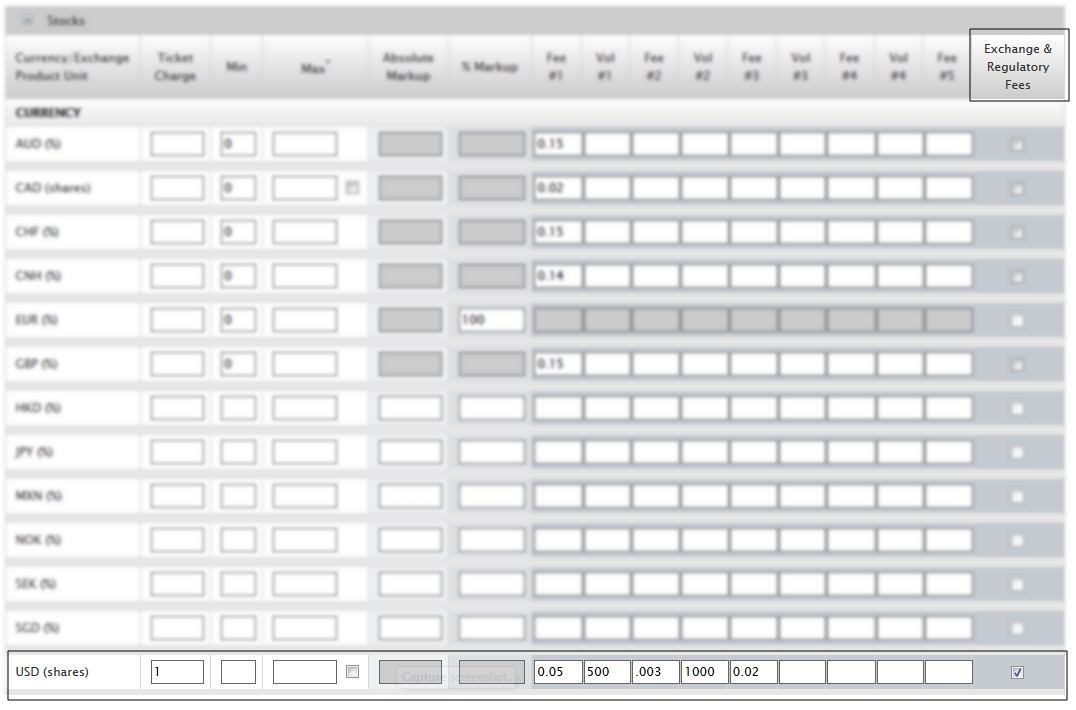

Brokers should monitor their customers commissions as it is possible for us to charge more than the client fee. To set an Absolute Amount, enter one to three fees (Fee#1, Fee#2, Fee#3), and enter volume breaks (Vol#1, Vol#2) on a per trade basis on the Client Fees page in Account Management. The units listed in the Currency/Exchange/Product Unit column indicate if the absolute markup gets applied to shares, contracts, or %. Absolute Amounts can include up to three decimal places.

Our standard UK fees of .1%, and stamp tax of .5% would be subtracted from the absolute fee specified above.

Customer Absolute Tiered Commissions are mutually exclusive from our Tiered Commissions. They can be combined with our Tiered Commissions, or one customer absolute rate can be used with our Tiered Commissions.

Example

For example, a broker wants to charge 0.05 USD for up to 500 shares of stock, 0.03 USD for up to 1,000 shares, and 0.002 USD above 1,000 shares, along with a ticket charge of 1 USD. The broker is only using three tiers but can use up to five tiers. The entries on the Client Fees page would look like this:

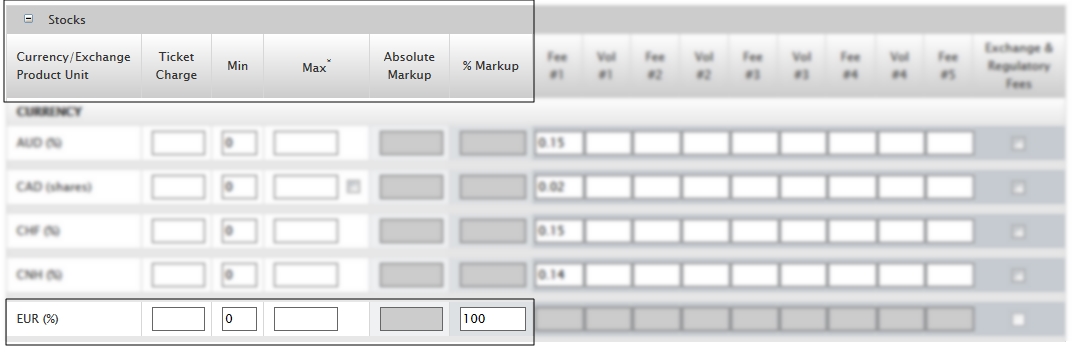

Brokers can specify a percentage of our standard commission to charge per trade. Enter % Markup as a percentage without the decimal point.

Example

For example, a broker enter 100 in the % Markup column for Stocks/EUR for an individual client, indicating that stock trades for this client will carry a broker markup of 100% of our commission. If we charge 10 EUR for a stock trade, the % Markup will be 10 EUR (100% * 20 EUR). The client will be charged a total of 20 EUR for a stock trade (10 EUR

In addition to (or on top of) an absolute fee, a broker can pass any exchange or regulatory fees through to the customer by selecting the Exchange & Regulatory Fees option. These fees can only be entered when Absolute Amounts are set. Brokers can also specify a tiered commission schedule and Exchange & Regulatory Fees for specific products and specific exchanges.

Example

For example, 1,000 shares @ $.05 per share + Exchange Fee of $.003 per share = (1,000 * .03) + (1,000 * $.003) = Total Fee charged of $33.00.

Brokers can mark down credit and short proceeds credit interest, and markup debit interest. Markups and Markdowns are specified percentages along with the following options:

Interest markups and markdowns are rounded to two decimals.

Brokers can charge markups to their clients based on our stock borrow rates, entered as a variable or fixed percentage of our borrow rate. You can enter both types of markups and our system will apply the markup rate that results in the larger total amount.

Borrow Markup Fee Example 1

Symbol ABC Borrow Rate = 35%

Variable Borrow Markup = 20%

Fixed Borrow Markup = 1%

Calculating the total cost to your client, we have:

Our system applies the larger total amount, so in this example, we would apply the Variable Borrow Markup and the total cost to your client is 42%, which includes our borrow rate plus your borrow markup.

Borrow Markup Fee Example 2

Symbol XYZ Borrow Rate = 0.25%

Variable Borrow Markup = 20%

Fixed Borrow Markup = 0.75%

Calculating the total cost to your client, we have:

Our system applies the larger amount, so in this example, we would apply the Fixed Borrow Markup and the total cost to your client is 1%, which includes our borrow rate plus your borrow markup.

Brokers can charge markups on prime trades of certain currency/product units in the Take Up Fees section on the Configure Fees page. This section only appears for brokers who have at least one client who subscribes to our IB Prime institutional service.

You specify the take up fee in the Ticket Charge field for the specific currency/product unit; for example, US Stock. A take up fee is simply a flat fee.